Hi everybody, this is Elia with Martin and Associates Insurance. Today, I'm going to talk about how you can apply to get your Part B and Part D income-related monthly adjustment amount reduced. Medicare looks at your gross adjusted income from two years ago and if you were a higher-income earner, they will charge you more for Part B and Part D. This is called IRMAA (Income-Related Monthly Adjustment Amount). If you've had a life-changing event such as stopping work, a reduction in work hours, or losing a spouse, you may qualify for a lower amount you have to pay for Part B and Part D. To apply, you will need to complete a form from the Social Security Administration. Fill out all the information and send it to them. They will decide if you qualify for the reduced amount. I received an email from a client who was making a higher income and getting charged more for Part B and Part D. I provided her with the forms, but she had to complete the process on her own since we can't get involved with the Social Security Administration. She sent out all the required forms and recently emailed me back, saying she was approved for the lowest amount. In 2017, it is $134 for Part B and no extra income-related adjustment amount for Part D. She used to pay more than $200-$300 a month for Part B, but now she only pays $134. The Social Security Administration will also refund her for the extra premiums she paid since she stopped working in May. This is how you can apply and see if you qualify to get your Part B and Part D income-related adjustment amount reduced to the standard rate. You can potentially get it reduced to as low...

Award-winning PDF software

Cms l457 Form: What You Should Know

CMS L457 CMS L457. Form Title. ACKNOWLEDGMENT OF REQUEST FOR MEDICARE MEDICAL INSURANCE TERMINATION. Revision Date. . O.M.B. #. EXEMPT. CMS Manual. SSA — POMS: NL 00701.117 — Form CMS-L457 dash Apr 24, 2025 — Form CMS-L457 is used to acknowledge receipt of the claimant's request for MEDICARE medical insurance termination. C. Preparation of form. The source of Acknowledgment Of Request For Medicare — Forms Workflow Nov 8, 2025 — Acknowledgment Of Request For Medicare Medial Insurance Termination {CMS-L457}. Start Your Free Trial 13.99. SSA Form Cm's L457 — Fill Online, Printable, Fillable, Blank Fill SSA Form Cm's L457, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with filler ✓ Instantly. Try Now! CMS L457 CMS L457. Form Title. Acknowledgment OF RECEIPT OF MEDICAL INSURANCE TERMINATION (CMS-L457). Revision Date. . O.M.B. #. EXEMPT. CMS Manual. SSA — POMS: NL 00701.117 — Form CMS-L457 dash Apr 24, 2025 — CMS-L457 is used to acknowledge receipt of the claimant's claim of MEDICARE medical insurance termination. C. Preparation of form. The source of CMS-L457 — CMS Form Cm's L 457 CMS-L457. Form Title. Acknowledgment OF RECEIPT OF MEDICAL INSURANCE TERMINATION {CMS-L457}. Revision Date. . O.M.B. #. EXEMPT. CMS Manual. Form L457 — CMS Form Cm's L457, edit. CMS L457 CMS L457. Form Title. Acknowledgment OF MEDICARE MEDICAL INSURANCE TERMINATION BY THE INSURER. Revision Date. . O.M.B. #. EXEMPT. CMS Manual.

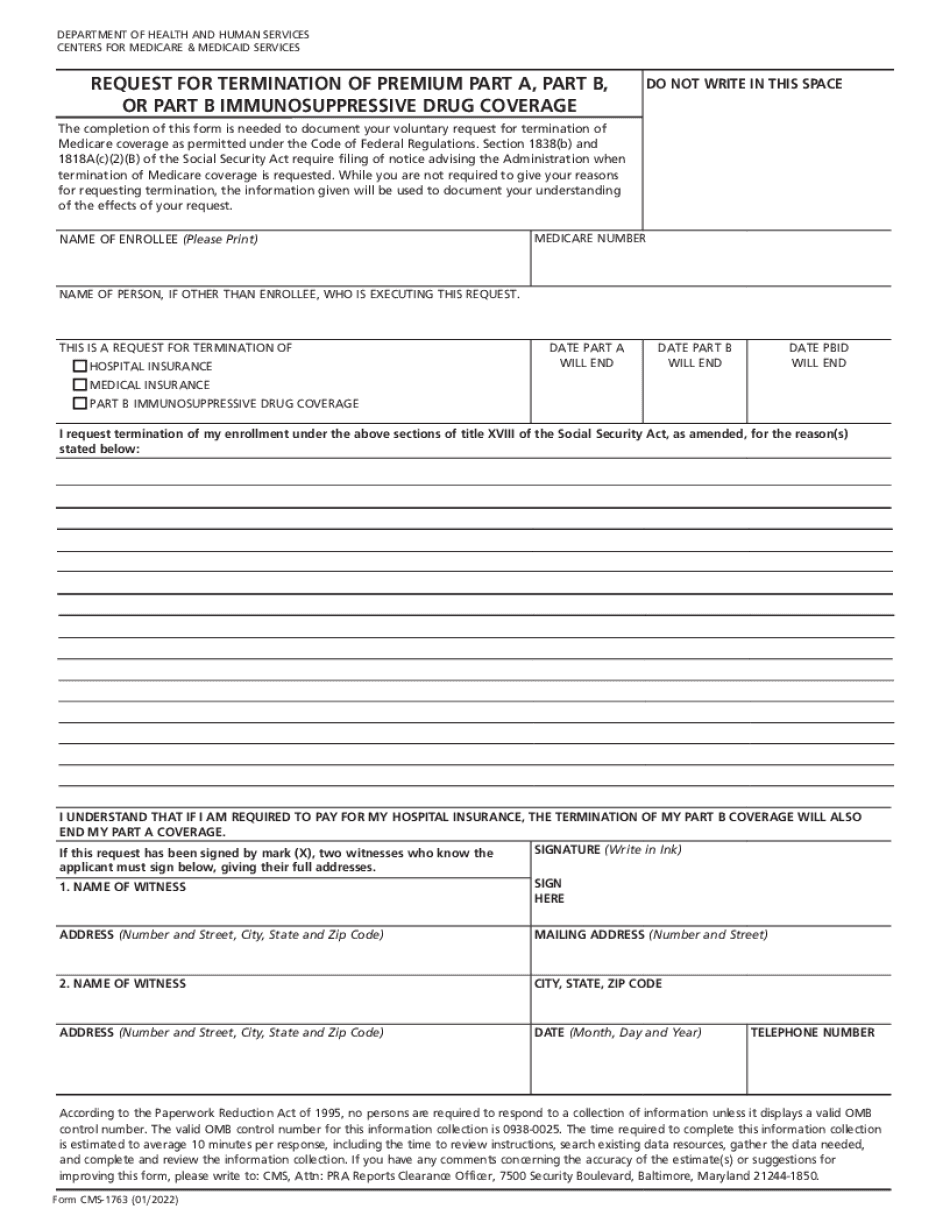

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do CMS-1763, steer clear of blunders along with furnish it in a timely manner:

How to complete any CMS-1763 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your CMS-1763 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your CMS-1763 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Cms l457