I'm gonna talk about signing up for Medicare. Where to do it, how to do it, when to do it - pretty important stuff, so stay tuned. Okay, so now it's time to sign up for Medicare. Some people find that exciting, some people find it devastating, some people don't care that much. You just want to make sure they get everything in order the way it's supposed to be. So I'm gonna walk you right through this, so you know where to go, when to go, how to go, and make sure you get everything done correctly. - So, there are a couple of different ways you might be coming into Medicare. Maybe you're turning 65 and you're ready to start Medicare. Or maybe you're still working past 65 but you're still in your group insurance, but you're gonna retire and now it's time to come into Medicare. And they both work pretty much the same way. So I'm going to show you exactly what you need. If you do work past 65, there are a couple of additional things you need to do, and I'll show you that as well. Or the other one is maybe you're under 65 and on disability, and now you're going to become eligible for Medicare. And I don't do Medicare disability, but I do want to help, and I have a video on Medicare disability that I think will point you in the right direction. So just visit my YouTube channel, search for disability, and we'll bring that video up, and hopefully, you'll find that helpful. - So, in the traditional sense, the turning 65 hours and the retirees that are going to be going into Medicare, this is what we need to do. So obviously, to sign up for Medicare, the first thing...

Award-winning PDF software

Accidentally signed up for medicare part b Form: What You Should Know

The What happens when I become disabled, and Part A is no longer paid? Your Part A coverage ends and the Social Security Administration will no longer pay the premiums. At that point you would switch to Medicare's Part B. I want to return to part A, but it is for a different Part B group to begin with. What are the differences in the Part B plan? You switch back to Part A for the same Part B group. You can also go back to group A if your plan is How to change from group 4 (Medicare Advantage), group 6 (Medicare Prescription Drug Coverage), or group 21 (Medicare Prescription Drug Coverage for Individuals) to group 1 (Medicare Part B) Group 1: Medicare Prescription Drug Coverage for Individuals. Medicare Part B is the lowest cost option. Who can choose which Medicare option (Part B, Part D, or Medicare Prescription Drug Coverage) to get? The following persons are not eligible for a Prescription drug plan under Part B: Anyone with a physical or mental impairment, and anyone who cannot work because of the physical or mental impairment because of an accident or condition they are involuntarily receiving medical treatment for (such as a veteran) A spouse or child/children of a Medicare beneficiary (such as a spouse if his/her employer pays the premiums) Anyone age 19 or older who will be attending college or any other postsecondary educational institution and who does not hold a current student medical insurance plan, or who cannot afford to pay for it after applying for Medicaid, is unable to pay for any type of medical services for the purpose of attending college or other postsecondary educational institution, and is not able to obtain health benefits coverage from another source that the State of Maryland approves of. Ineligible individuals are eligible for Group P, the group Medicare program for the elderly that offers Medicare Part B to individuals over the age of 65 who do not qualify for Medicare Part B or Medicare Prescription Drug Coverage.

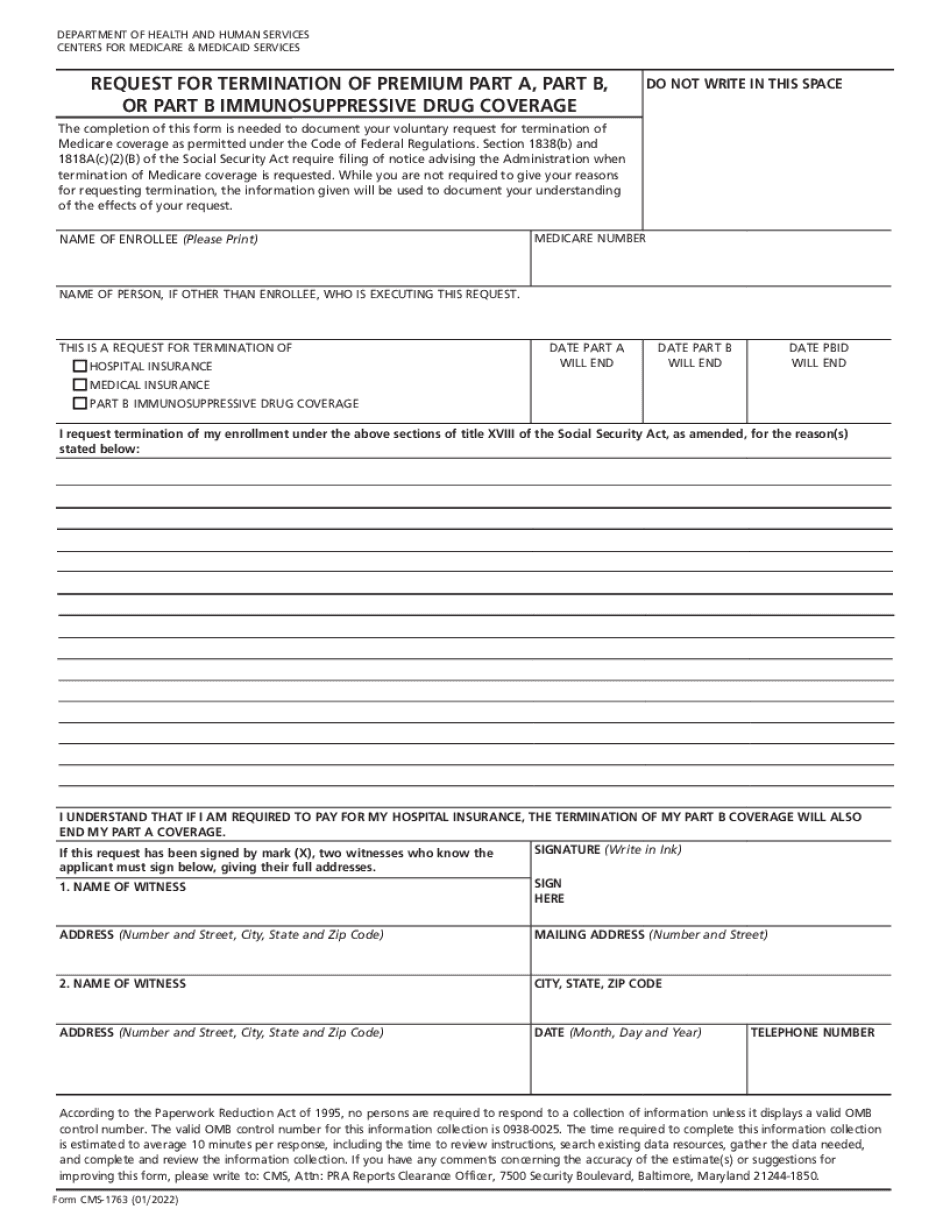

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do CMS-1763, steer clear of blunders along with furnish it in a timely manner:

How to complete any CMS-1763 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your CMS-1763 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your CMS-1763 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Accidentally signed up for medicare part b