Did you know that your household income will affect how much you'll pay for Medicare parts B and D? In this video, I'll discuss how Social Security calculates what you pay for your Medicare benefits and how you can file an appeal to have that premium lowered. Be sure to stay to the end for the specific forms you'll need to file your appeal. While most people on Medicare pay nothing for their part A hospital benefits, they do pay for their Medicare Part B outpatient benefits. Every year, Medicare sets the Part B premiums for Medicare beneficiaries. This amount slowly climbs over time due to ordinary healthcare inflation. In 2018, most new enrollees pay a hundred and thirty-four dollars a month for Part B. However, about five percent of beneficiaries pay more because they earn more, and Medicare calls this an income-related monthly adjustment amount or EMA for short. So, how much more will you pay? That will be determined by Social Security. Here's how they do it: each fall, the IRS sends your tax return information over to Social Security. The folks at Social Security will review your modified adjusted household gross income from the last tax return that they have on file for you. This is usually your tax return from two years prior to the current year. For example, this fall, Social Security will notify you what you're going to pay in 2019, and that will be based on your 2017 tax return because you haven't yet filed your tax return for 2018. Now, I'm sure you're wondering what types of income are included in the modified adjusted gross income. Your modified adjusted gross income is generally the total of your household adjusted gross income plus any tax-exempt interest income you may have earned. These can be found on...

Award-winning PDF software

Cms 40b 2022-2025 Form: What You Should Know

O. Box 152569, St. Louis, MO 63139), then mail back the completed documents to: Administrative Office of the U.S. Department of Health and Human Services Office of Management and Budget 2021 C Street, S.W. Washington, DC 20. This form gives you the opportunity to apply for Medicare Part B, the Health Insurance Marketplace or choose to continue to obtain health insurance through health insurance exchanges. What is this information? CMS-40B Application for Enrollment in Medicare Part B (Medical Insurance) This form is filed with the federal government by you, the applicant. If you file the CMS- 40B form electronically, you won't need a paper copy of it. It is filed on computer and can be downloaded or printed electronically. This form is also filed with the Social Security Administration (SSA). This form does not change your Medicare eligibility. This form applies only to Medicare Part B (Medical Insurance) and does not change your Medicare benefits, such as health and dental coverage. If you are not eligible for Medicare Part B, you may have other federal health insurance benefits. You can talk to your primary care physician or other health care provider to find out if you qualify for Medicare Part B. How to use this form The application that is filed must be completed and signed in ink by you. You must complete this form if you want to use the Marketplace or your health insurance. The form can be signed electronically or printed with a computer. The original must be mailed. You cannot take this Form to a Social Security office if you have already filed your income tax return. Payment for Form CMS-40B (Application for Enrollment in Medicare — Part B [Medical Insurance]). CMS-2021 Form The CMS-2021 forms, CMS-40B, CMS-2021, CMS/L564, CMS/L564, and CMS-2021 can only be paid in cash or checks by individuals, corporations, trusts, estates, and nonprofit organizations, with a minimum of 10,000 in cash. These forms cannot be paid by wire transfer (SWIFT or MasterCard), credit card, debit card, or charge card.

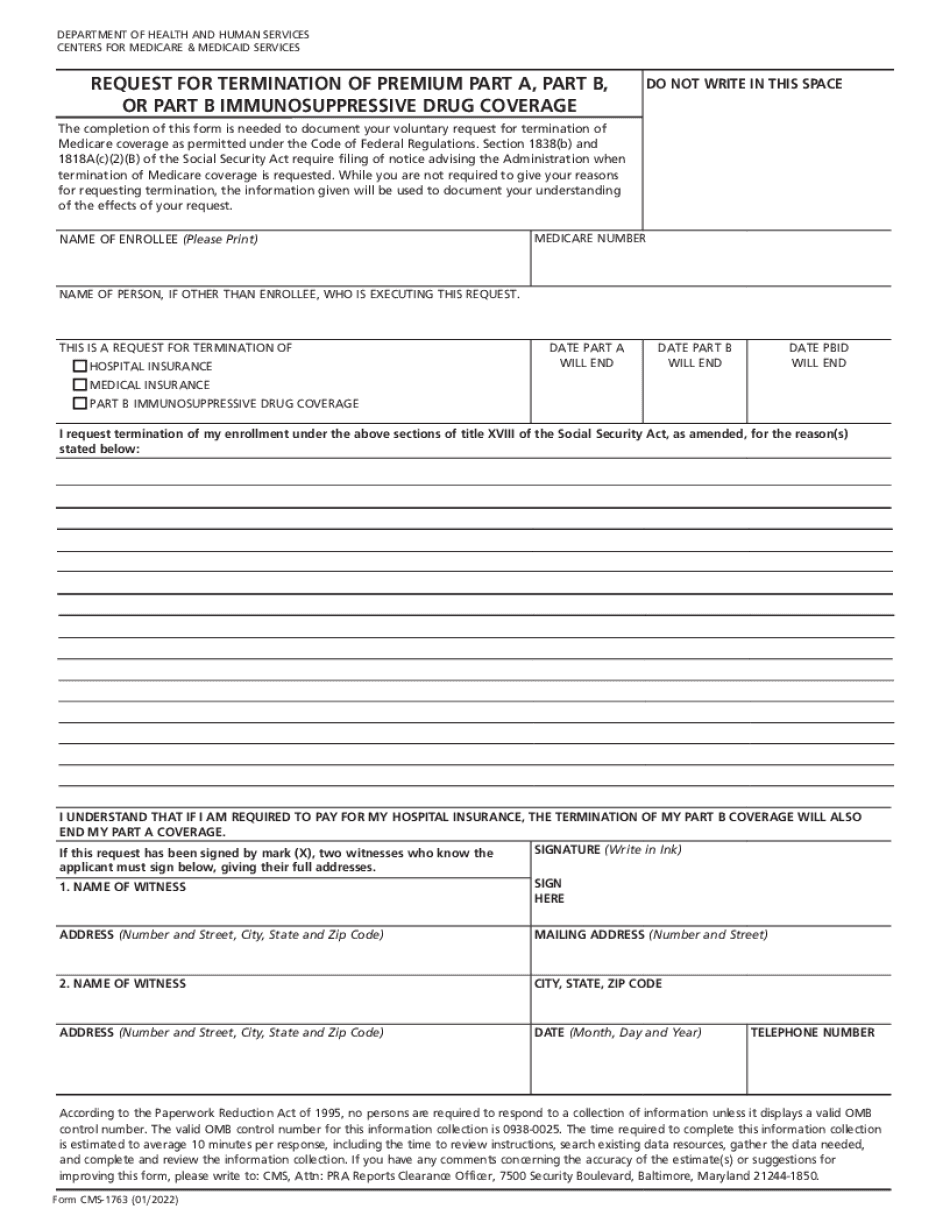

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do CMS-1763, steer clear of blunders along with furnish it in a timely manner:

How to complete any CMS-1763 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your CMS-1763 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your CMS-1763 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Cms 40b 2022-2025